The Mining sector's window for transformation

Blog

There will never be a better time than now for the mining sector to begin embracing Industry 4.0 technology.

The mining sector has never been in a better position to deliver real, transformative change than now.

In 2020, when many industries were being hammered financially by the COVID-19 pandemic, net profits amongst miners rose by 15% and market capitalization increased by 64%, with 2021 expected to be an even bigger boon - with revenue expected to increase by 29% and profits 68%*.

These figures are a result of surges in commodity prices and new revenue streams coming from the ever-increasing demand for minerals used in clean energy technology - something that’s expected to increase 6-fold in the next 20 years alone.

In fact, Wood Mackenzie predict that, for the world to achieve its net-zero goals, the aluminum, copper and nickel industries would have to double in size by the late 2020s, while lithium and cobalt mining would need to increase five-fold . According to the World Bank Group, clean energy needs will escalate the demand for rare earth minerals by nearly 500% by 2050.

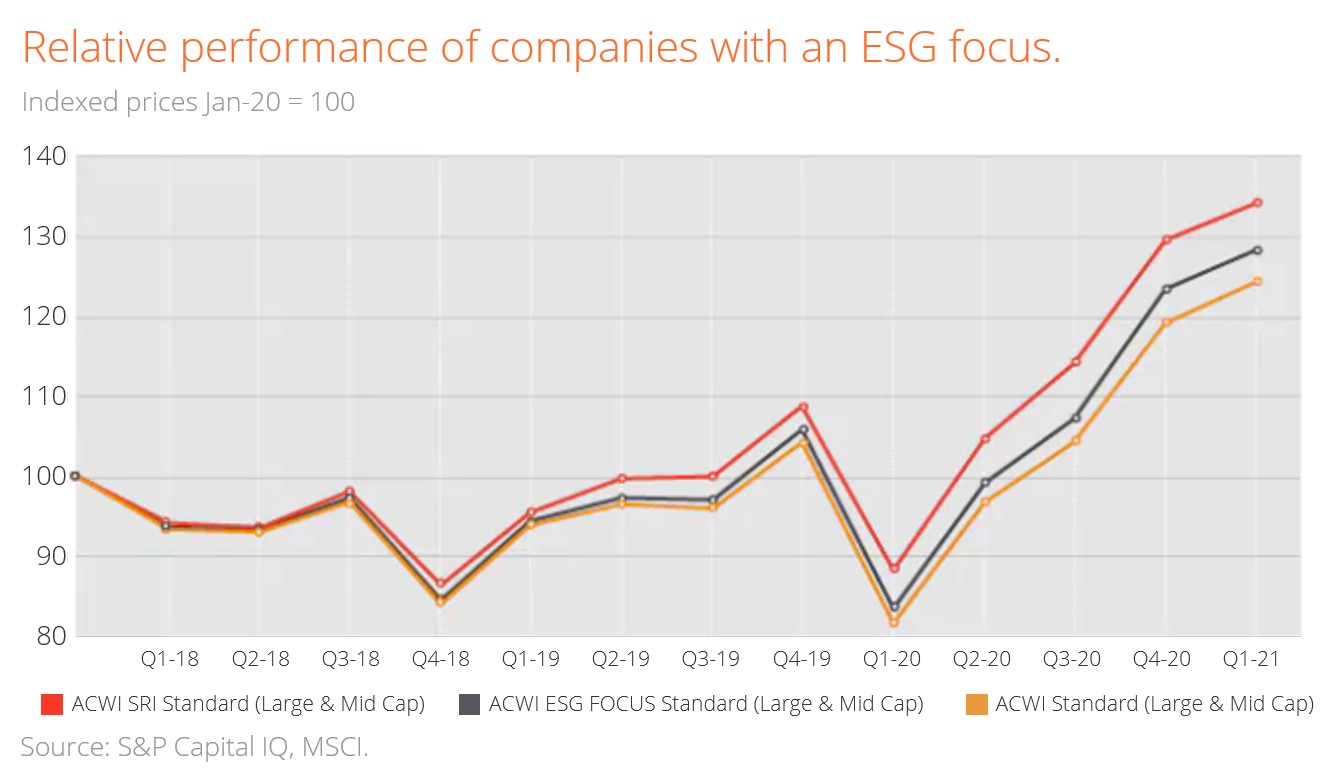

If this wasn’t enough good news, the data is also beginning to come in and it shows that businesses with an ESG focus are outperforming those without it - and did so even throughout the global pandemic.

If this wasn’t enough good news, the data is also beginning to come in and it shows that businesses with an ESG focus are outperforming those without it - and did so even throughout the global pandemic.

The net result of these factors is that many of the world’s largest diversified miners have never been in a stronger financial position. With no immediate end in sight for the commodity price boom or demand, despite a volatile 2022-2023 period in some commodities being expected (a fall-back in iron ore prices and temporary reduction in demand for steel off the back of microchip shortages slowing electric vehicle production**), short-term profitability is all but guaranteed.

This makes now the time for the mining sector to be investing in its future and to be putting in place transformation programs that will enable it to fulfil its role in helping the world achieve energy transition, as well as meeting its own zero carbon, zero harm and zero waste ESG targets.

Failure to seize this opportunity will result in existential challenges that at present are in the medium-to-long term looming into view at a point where it will be too late for some businesses, particularly in the West, to alter course.

Whilst this is a known known, there still seems to be significant inaction. Wood Mackenzie have stated that there is currently insufficient investment from miners in these new spaces for the world to be able to meet its net-zero 2050 targets [“The key question is whether the industry at large is investing enough capital to drive the transition from the ‘carbon electron’ to the ‘green electron’ at anything close to a level that will achieve a 2 °C pathway. The simple answer is no.” ] and there is a real risk that if miners don’t start moving the needle themselves, that someone else might start setting targets which are somewhat more challenging (and costly) to achieve. There is even the risk that other sectors powered by new technologies - such as scrap utilization - might start eating the mining sector’s lunch sooner than predicted.

Obtaining capital from the financial sector needs to be easier, with investors needing to take a longer-term view than their previous activities, and it could be that government support for green initiatives may well need to play more of a role - but the key for the world’s miners is that they need to start doing more than simply trying to improve what they’re doing now if they’re to plot a profitable path that secures their futures.

I4 Mining is a sustainability technology provider to the mining sector, offering ready-to-deploy ESG solutions that help miners to succeed both strategically and operationally without ever getting in the way of good business.

Our solutions enable you to easily develop strategies, deliver accurate sustainability metrics and reports in real-time, improve sustainability and business performance, as well as make predictive analytics and forecasts part of your everyday so that you can reduce risks and optimise from mine-to-market.

Speak to us today to book a demo and discover how you can get started on your digital sustainability journey.

* Source: PwC: Mine 2021

† Source: https://www.woodmac.com/news/opinion/are-we-on-the-cusp-of-another-mining-super-cycle/

** Source: Australian Government Department of industry, Science, Energy and Resources Quarterly, Sep-21

‡ Source: https://www.woodmac.com/news/opinion/why-high-dividends-may-not-pay-off-for-mining/

Want to know about industrial AI + IoT more broadly?

If you'd like to find out more about the technology that underpins all of our digital mining solutions, other industrial uses of AI + IoT, or are eager to get into the detail of precisely what AI and IoT technology are then visit the Rayven blog.