The challenge (and benefits) of an enhanced ESG focus in mining.

Blog

SDG and ESG goals have now taken center stage within the mining sector.

The lifecycle of a mine is a multi-faceted, complicated thing.

At all stages, the environment and the community that exists around sites are affected and impacted in multiple, evolving ways -and the sector’s footprint is significant.

Mines cover 57,277km2 of the earth’s surface*, consume 3% of the world’s water†, and account for 4% -7% of greenhouse gas emissions globally‡. Every year, 61.1bn tons of metal ores, fossil energy, and non-metallic minerals are extracted, up 55% in 20 years, with an additional 20.5bn tons of biomass removedΩ.

Regulatory limits, industry standards and judicial intervention have, therefore, been used to shape miners’ environmental approach over the last century. The Environment Protection and Biodiversity Conservation Act 1999 in Australia and National Environmental Policy Act of 1969 in the US -to name just a two pieces of federal legislation (international, state and local legislation, as well as individual site agreements have all played a role, too) - have impacted miners’ policies and ensured that the environment is considered across operations.

Adhering to these rules is expensive. Compliance with environmental regulation costs the industry AU$1.5bn per year in Australia alone** and whilst many countries’ regimes vary in strictness, as well as whether they adopt a ‘polluters pay’ approach, the cost to miners

is significant.

In past decades, compliance with national regulatory frameworks has been enough and the sector - despite the many detractors - has actually been at the vanguard of promoting ESG and sustainable development, but compliance and old approaches are no longer sufficient: miners and the businesses that serve them need to do more -and they know it.

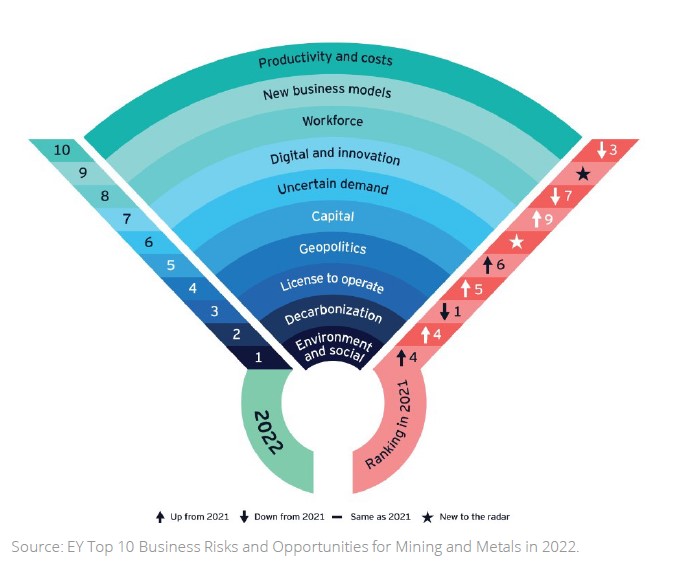

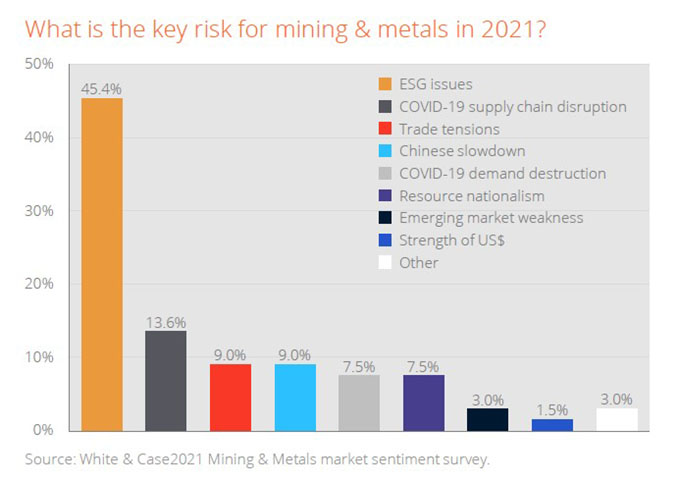

In the most recent report of its nature by EY, ‘Top 10 Business Risks and Opportunities for Mining and Metals in 2022’, global mining executives ranked Environment, Social and Governance (ESG); Decarbonization; and License to Operate (LTO) as the top three risks/opportunities facing their organizations over the next 12 months - above challenges related to capital, uncertain demand, workforce, productivity and digital/innovation. White & Cases’ 2021 report ‘Mining & Metals Market Sentiment Survey’ said much the same thing.

Why?

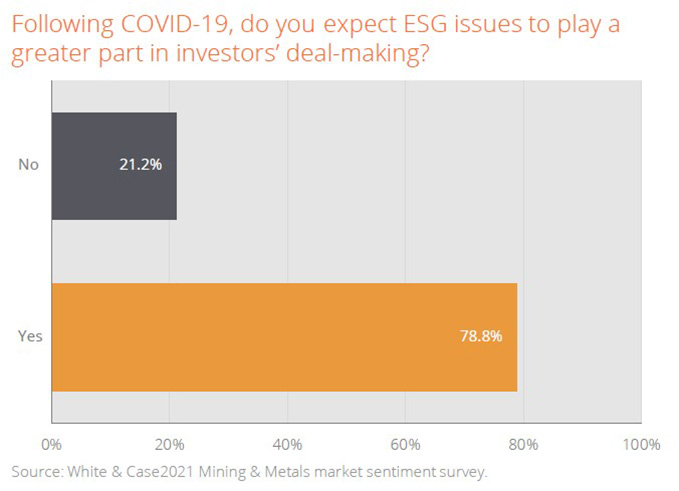

There are many answers to this. Outside of medium-to-long-term zero carbon arrangements (such as the Paris Agreement and individual state/national targets), the societal and political zeitgeist has evolved to a point where, although the sector’s role in achieving energy transition is undeniable, it needs to do more. The consequences of missteps have grown significantly at both a corporate and individual executive level (see Rio Tinto’s experience at Juukan Gorge or Vale’s at Córregodo Feijão) and miners’ ability to expand or open new sites are now subject to stricter LTO and capital requirements that factor in short, medium and long-term ESG risks.

The sustainability of the sector and success of the people that work within it are now even more directly tied to the environment and the community that surrounds their operations.

The challenge (and benefits) of an enhanced ESG focus.

Much of the world’s easily mineable sites have already been tapped and new locations with minerals of sufficient volume and quality to warrant investment are generally in either more environmentally sensitive areas, may be in direct conflict with the needs of the local population, or are in parts of the world considered difficult to do business.

Nearly all of the world’s major miners have committed to net-zero carbon targets by 2050 (or sooner), have a raft of ESG strategic initiatives (including zero harm goals), and are ploughing significant amounts of time and expense into transforming (and ensuring that they are being seen to do so).

Whilst there is a real risk that if miners don’t start moving the needle themselves that someone else might start setting targets which are somewhat more challenging (and costly) to achieve -or that they may leave themselves open to new ’disruptive’ technologies, such as scrap utilization -there are significant benefits to adopting an enhanced ESG footing beyond decreasing risk and avoiding interference from investors and governments.

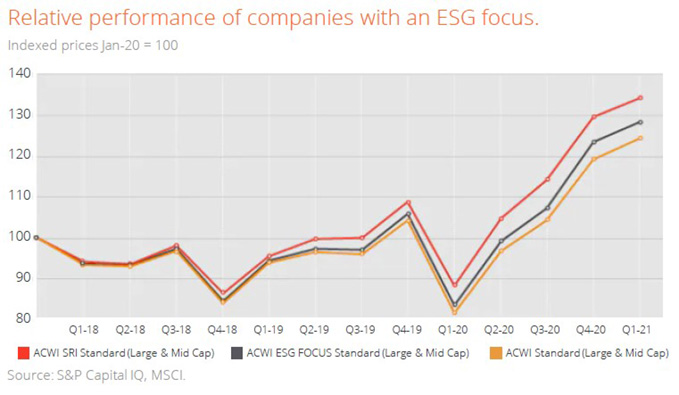

Data is beginning to emerge that suggests that businesses with an ESG focus are outperforming those without it -and did so even throughout the global pandemic(see chart to the right).

The bottom-line, quite literally, when it comes to ESG initiatives is that operations that are more efficient are more productive - a fact that shouldn’t be a surprise given we were all taught The Second Law of Thermodynamics at school. In achieving efficiency, you reduce the volume of unwanted by-products, find new ways of operating, and increase output -i.e. you lessen the negative impact on the environment and increase profits.

For miners, there are many benefits:

- Reduce inputs - water, chemicals and everything else that goes into day-to-day operations comes at a cost. If efficiency is improved, you lessen the amount used or find ways of recycling, directly impacting the bottom-line and profitability of an operation.

- New outputs - new technologies and techniques are making it possible to find value in previous waste products, such as tailings, which reduces environmental impact and increases outputs.

- Extend LTOs - by proving green credentials and making mining operations more transparent, miners can find it easier to get new or extended LTOs, meaning that output, lifespan and productivity rates of existing operations can be extended.

- Cheaper energy - initial CAPEX to set-up on-site energy generation via renewables comes at a cost, but on sites that have a long or even medium-term future, this can pay itself back multiple times.

- Reduced workforce - people are a significant OPEX. By leveraging automation technologies and robotics, you make environments safer and reduce the need for in-field personnel.

- Enhanced production - production processes that are geared towards efficient, maximum-yields inevitably reduce the number of unwanted by-products that could be environmentally detrimental and increase productivity rates.

- Longer asset lifespans + reduced maintenance costs - modern electric plant, machinery and equipment have fewer moving parts. This means they’ll operate for longer with fewer interventions and produce the new lifeblood for the sector: accurate, real-time data.

Poor ESG performance adds risk. Industry 4.0 technology and pre-built sustainability solutions can mitigate this and will play a growing role in enabling miners to seize on new benefits; achieve their zero carbon, zero harm and zero waste goals; and evolve to be ready for the ever-more environmentally conscious future that awaits us.

I4 Mining is a sustainability technology provider to the mining sector, offering ready-to-deploy ESG solutions that help miners to succeed both strategically and operationally without ever getting in the way of good business.

Our solutions enable you to easily develop strategies, deliver accurate sustainability metrics and reports in real-time, improve sustainability and business performance, as well as make predictive analytics and forecasts part of your everyday so that you can reduce risks and optimise from mine-to-market.

Speak to us today to book a demo and discover how you can get started on your digital sustainability journey.

*Source: Maus, V., Giljum, S., Gutschlhofer, J. et al. A global-scale data set of mining areas. Sci Data 7, 289 (2020)

† Source: Australian Bureau of Statistics, 1301.0 -Year Book Australia, 2003

‡ Source: McKinsey: Climate risk and decarbonization -January 28, 2020

Ω Source: https://www.theworldcounts.com/challenges/planet-earth/mining/environmental-impacts-of-mining/story

** Source: CSIRO https://www.csiro.au/en/work-with-us/industries/mining-resources/social-and-enviromental-performance/minesite-environmental-management

Phillip McBride

CSO & Technologist @ Rayven

phillip@rayven.io

LinkedIn

Want to know about industrial AI + IoT more broadly?

If you'd like to find out more about the technology that underpins all of our digital mining solutions, other industrial uses of AI + IoT, or are eager to get into the detail of precisely what AI and IoT technology are then visit the Rayven blog.